India Automotive Wiring Harness Market: Innovation, Growth Drivers, and Competitive Landscape (2021–2029)

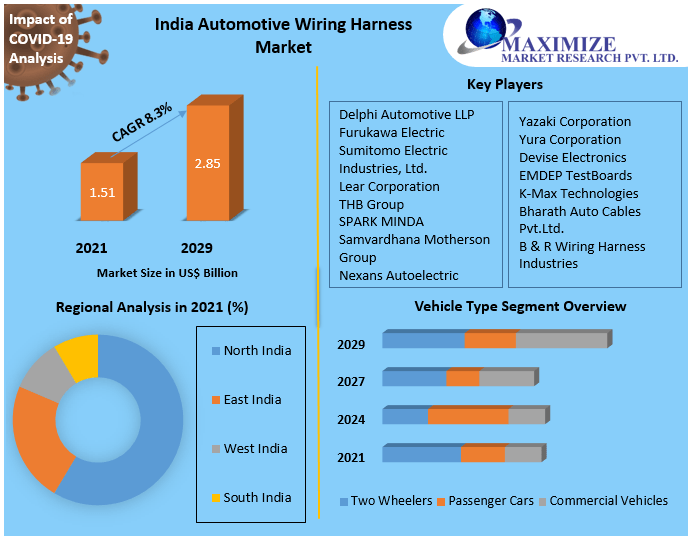

The India Automotive Wiring Harness Market was valued at USD 1.51 billion in 2021 and is poised to reach USD 2.85 billion by 2029, growing at a CAGR of 8.3% during the forecast period. This growth reflects the ongoing technological evolution in the automotive industry and the rising demand for safer, smarter, and more connected vehicles across India's dynamic mobility landscape.

Market Overview

Automotive wiring harnesses act as the central nervous system of a vehicle, integrating the electrical components for optimal communication and performance. In India, the rapid advancement of automotive technologies—especially ADAS, infotainment systems, electrification, and advanced lighting solutions—has significantly increased the complexity and demand for high-quality wiring harness systems.

These harnesses are not only essential for power and signal transmission but also contribute to vehicle weight reduction, fuel efficiency, and compliance with emission norms, making them indispensable in both ICE and EV vehicles.

Unlock key market insights by accessing the sample report through the link .@https://www.maximizemarketresearch.com/request-sample/43390/

Key Market Drivers

???? Automotive Industry Growth in India

India’s booming automobile sector, led by passenger car and two-wheeler segments, is a significant driver. Increasing urbanization, rising disposable incomes, and a growing middle class have resulted in higher vehicle demand, directly stimulating the wiring harness market.

⚙️ Rise in Advanced Vehicle Features

Modern vehicles are equipped with a suite of electronics—from automated gearboxes to smart dashboards and electronic power steering systems—which require integrated wiring harnesses. This has accelerated the demand for optical wiring and modular harness systems that can handle more data with less weight.

⚡ Push for Electrification and Emission Control

With the Indian government encouraging EV adoption and stricter emission norms (like BS-VI standards), the demand for lightweight and efficient wiring systems has surged. Electric vehicles, in particular, require extensive and customized wiring harness layouts for battery management and motor control.

Challenges Restraining Market Growth

-

Environmental Impact and System Failures: Harsh weather conditions, including extreme heat and monsoons, can lead to short circuits, insulation degradation, and corrosion, increasing maintenance and replacement costs.

-

High Replacement Costs: Malfunctions in wiring harness systems often require full replacements rather than partial fixes, especially in advanced vehicles—resulting in higher repair expenses.

Market Opportunities

-

Integration of Safety Sensors: With increasing adoption of blind-spot monitoring, lane assist, and automated steering, demand is rising for specialized harnesses that can support these sensors.

-

Growth in Two-Wheeler and EV Segment: India’s dominance in two-wheeler manufacturing and the aggressive push for EV adoption offer tremendous growth opportunities for wiring harness manufacturers.

-

‘Make in India’ and FDI Encouragement: 100% FDI in the auto industry and India’s strong base of skilled labor and component suppliers are inviting global manufacturers to invest and localize their harness production.

Segment Analysis

???? By Material Type

-

Optical Wiring (glass and plastic optical fibers) is gaining traction due to its superior data transmission speed, low electromagnetic interference, and suitability for futuristic vehicle technologies. Although it held <2% share in 2021, this segment is expected to see exponential growth.

-

Copper wiring remains dominant due to its conductivity and reliability, but faces competition from lighter alternatives as OEMs seek fuel efficiency.

???? By Application

-

Engine and Chassis Harnesses are the most widely used, critical for core vehicle operations.

-

Battery and Dashboard/Cabin Harnesses are witnessing strong growth, especially in EVs and digitally enhanced vehicles.

???? By Vehicle Type

-

Passenger Cars lead the segment due to the growing demand for infotainment, ADAS, and cabin comfort features.

-

Two-Wheelers, a massive market in India, are increasingly adopting more complex wiring for electric models and smart features.

-

Commercial Vehicles rely on robust harnesses for safety, engine control, and telematics.

Gain Valuable Market Insights by Exploring the Sample Report :https://www.maximizemarketresearch.com/request-sample/43390/

Regional and Policy Outlook

India's strong push for electric mobility, smart cities, and localized auto component manufacturing supports the long-term growth of the wiring harness sector. Government incentives under FAME India Scheme, PLI schemes, and the Auto Component Manufacturing Policy are further propelling investment into this market.

Competitive Landscape

Key players in the Indian market are employing both organic (product launches, innovation, R&D) and inorganic strategies (partnerships, acquisitions, and joint ventures) to consolidate their positions.

???? Notable Companies

-

Yazaki Corporation – Focused on expanding its footprint in India through partnerships and product innovation.

-

Sumitomo Electric Industries – Prioritizing advanced optical harness solutions and localization strategies.

-

Samvardhana Motherson Group – A leading homegrown supplier known for global collaborations and integrated manufacturing capabilities.

-

Furukawa Electric, Delphi, Lear Corporation – Leveraging their global R&D to introduce modular and weight-optimized harness systems tailored to Indian OEM requirements.

Other emerging players like SPARK MINDA, Devise Electronics, and Bharath Auto Cables are also carving out niches by focusing on custom harness solutions and flexible manufacturing setups.

Conclusion and Future Outlook

The India Automotive Wiring Harness Market is on a high-growth trajectory, powered by technological advancement, rising EV penetration, and evolving consumer preferences. As vehicles become increasingly software-defined and connected, the demand for high-quality, durable, and lightweight wiring systems will continue to surge.

With robust domestic demand, policy support, and ongoing digital transformation in vehicles, India is set to become not only a major consumer but also a global supplier hub for automotive wiring harness solutions by the end of this decade.

Comments on “India Automotive Wiring Harness Market Size Set for Robust Expansion 2029”